Impact Stories

Discover examples of how Benori’s insights and expertise create measurable value

Conducting Sentiment Analysis for Benchmarking Competitors

Objective and Scope:

The client, a consulting and advisory firm, wanted to assess brand perception and customer satisfaction and conduct a comparative benchmarking analysis of three companies. For this, it sought Benori's support in: Analyzing customer feedback, reviews, and ratings to identify key pain points and positive experiences Comparing customer perceptions across the selected companies to understand relative strengths and weaknesses Identifying opportunities for service enhancements and competitive differentiation

Approach:

Benori employed web scraping to collect customer feedback from platforms such as review sites and travel forums. Used GenAI capabilities, including LLMs, to analyze sentiment across the entire customer journey, from bookings to room services. Iterative prompt engineering was applied to refine sentiment classification into positive, negative, or neutral.

Impact:

The study enabled the client to Benchmark brand perception across three companies to understand competitive positioning Develop data-driven strategies to boost customer satisfaction and loyalty Enhance communication and marketing initiatives using sentiment trends and feedback analysis

Benchmarking Companies for a Global Venture Capital Firm

Objective & Scope

The client, a large, global venture capital firm, wanted to optimize the shortlisting of start-ups that could be profitable investment opportunities. For this, it sought Benori’s support in: Tracking growth indicators of 450+ companies in the enterprise technology and consumer space Highlighting outliers that could be explored for investment

Approach

Benori built an automated analytics pipeline that aggregated data from multiple digital and financial sources, including Crunchbase (funding, valuation, investors, employee growth), LinkedIn (hiring velocity), SimilarWeb (web traffic), and news APIs (mentions and sentiment) into Azure SQL, orchestrated via Azure Data Factory. Feature engineering derived key growth signals, including year-on-year (YoY) changes in employees, funding, valuation, traffic, hiring velocity, and sentiment trends, which were combined into a composite growth potential score. Anomaly detection flagged outperforming peers, and insights were visualized through a dashboard, enabling rapid identification of high-growth companies and emerging investment opportunities backed by real-time data.

Impact

The exercise enabled the client to: Make faster, data-driven investment decisions by automating start-up monitoring Highlight high-growth opportunities through a real-time analytics dashboard

Building a Centralized Dashboard for Regulatory Change Management in the F&B Industry

Objective & Scope

The client, a leading FMCG company, wanted to proactively track and manage regulatory changes impacting the food and beverages (F&B) industry in India. To achieve this, it sought Benori’s support in: Continuously monitoring regulations across food categories and themes, supported by automated alerts Creating a structured, central repository of regulatory data that provides a real-time view of upcoming changes and their timelines, and establishing an impact analysis framework for the identified regulations

Approach

Built a solution to continuously monitor regulations across various food categories and themes for regulatory change management in the F&B industry. Using Power BI with Microsoft Dataverse, the platform automatically captured updates from regulatory websites, enriched by analyst inputs. The system enabled users to view regulations, drill into details, add time-stamped comments, and track tasks in a single interface. Automated email alerts ensured real-time updates, creating a unified, actionable platform for regulatory tracking and management.

Impact

The integration of real-time regulatory tracking with a centralized, collaborative dashboard enabled the client to: Receive automated alerts for new or updated regulations Automatically assign tasks to relevant team members to streamline the compliance workflow Facilitate real-time impact analysis, allowing stakeholders to quickly assess and react to regulatory changes

Identifying Innovative Digital Business Models in the Retail Industry

Objective & Scope

The client, a consulting firm, was supporting a government entity in assessing digital business models in the retail industry, for instance, dark stores, autonomous stores, and peer-to-peer (P2P)/peer-to-merchant (P2M) platforms. It sought Benori’s support to: Identify and benchmark various business models, along with their functional and deployment processes Evaluate the types of interventions and regulations (in the form of policies and initiatives) that the governments are planning and implementing in the retail space

Approach

We created an exhaustive list of distinct and innovative business models. Based on their tech advancement, ROI, and regional fit, 11 business models were shortlisted. These were profiled in detail, outlining their technologies, key players, implementation sub-sectors, case examples, potential business impact, and implementation considerations. Additionally, we captured the government interventions, including those adopted and in the pipeline, across a list of countries

Impact

The research helped the client in: Assessing the feasibility of these models for businesses and evaluating their potential impact upon implementation Delivering actionable insights to the end client by synthesizing data on how various countries have adopted these business models

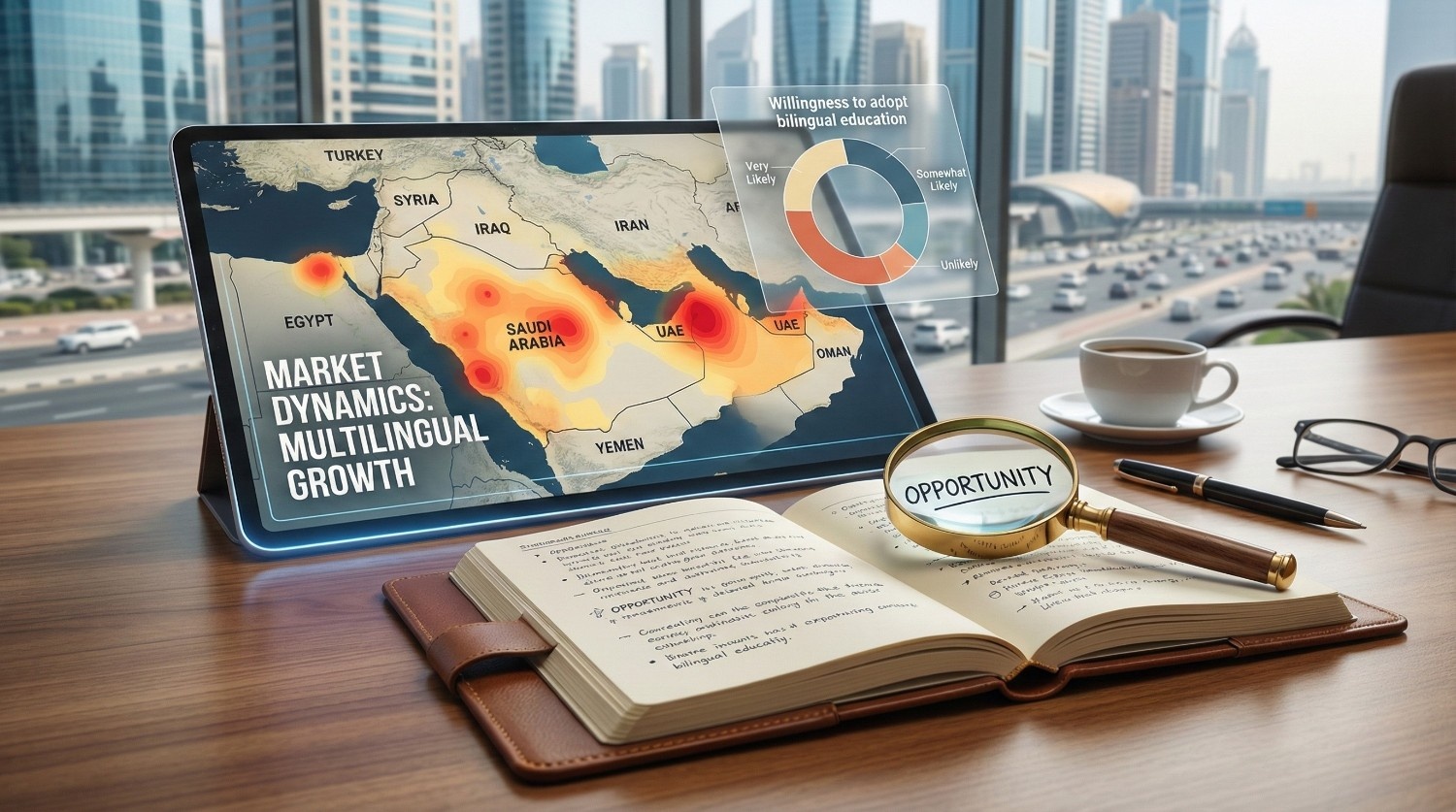

Assessing opportunities in Digital Healthcare market in Middle East

Objective & Scope

The client, a leading hospital chain, wanted to expand its digital offerings in a Middle East country by developing a user-centric, digital-first healthcare platform. For this, they sought Benori’s support to: Evaluate the digital healthcare market, focusing on telehealth, m-health, and e-pharmacy initiatives Analyze factors affecting patient engagement, satisfaction, and adoption barriers Assess competitive dynamics and identify key players, service offerings, pricing, and value propositions across segments

Approach

We evaluated the digital healthcare segments and assessed their sizes to identify potential opportunities. We surveyed customers and businesses to understand their pain points and requirements. We conducted secondary research to understand the competitive landscape, including key players such as hospitals and telehealth platforms. We benchmarked them based on their digital offerings, levels of adoption, and customer ratings.

Impact

The detailed insights helped the client in: Developing a strategy to explore the digital space and capitalize on the identified opportunities Addressing the challenges highlighted in the study faced by their clients Assessing key players’ market positions in the digital landscape and identifying ways to enhance their current offerings and add new ones

Conducting Opportunity Assessment for a Leading Bank

Objective & Scope

The client, a leading private bank, wanted to conduct an in-depth assessment of the opportunity areas for its services. It sought Benori’s support in understanding: Market and industry growth trends for private banking services for the high-net-worth individuals (HNIs) segment Competitive landscape of 7-8 leading players Consumer needs gaps

Approach

We conducted in-depth secondary research to understand the competitor landscape, HNIs, and trends in the movement of India’s wealth and their drivers, growth prospects, and investment inclinations. We conducted primary research, including interviews with industry experts, affluent individuals, and HNIs, to understand their investment-making journeys and expectations.

The detailed insights helped the client in: Understanding the total addressable market for its services Assessing competitors’ business model, service offerings, strategy, positioning, focus, distribution/service channel Consumers’ views and perceptions towards the investment solutions and wealth services offered in the market

Conducting Value Chain Assessment of the Ketchup and Mayonnaise Market

Objective & Scope

The client, a leading player in the FMCG sector, sought to gain a comprehensive understanding of the best practices adopted by key players in the ketchup and mayonnaise market in India. The objective was to analyze the entire value chain, from raw material procurement to processing, packaging, and distribution, while gaining key operational insights. For this, they sought Benori’s support to: Assess the production process, including raw material procurement strategies, backward integration, manufacturing operations, packaging, technological sophistication, and the cost model Analyze market performance, covering sales, product mix, and distribution management with their associated costs

Approach

We conducted extensive desk and primary research to analyze the ketchup and mayonnaise value chain of selected players. This included evaluating procurement strategies, manufacturing and packaging operations, associated costs, sales, and distribution. We engaged with key stakeholders to gather insights on sourcing practices, production capacities, cost structures, product offerings, and technological adoption. This combined approach enabled us to validate findings, address data gaps, and provide actionable insights into the overall cost structure of these products.

Impact

The research helped the client in: Understanding the value chain of key players relating to ketchup and mayonnaise, associated cost of raw material and project management, conversion cost for specific pack types, as well as gross margins Understanding the overall distribution model, warehousing and logistics costs, and key channels served

Evaluating the Operations of a New Age Personal Care Player in India

Objective & Scope

The client, a leading CPG firm, wanted to understand the operations of a manufacturer of personal and baby care products. It wanted to assess its best practices across sales and distribution operations, and sought Benori’s support to: Analyze the player’s key sales and distribution channels and revenue in India Identify top consumption hubs, sales fulfilment models deployed, and promotion strategies Assess margin structures, turnaround time with channel partners, and associated costs

Approach

Our approach was to break down and study every sales channel and order fulfillment model for both online and offline sales. We conducted secondary research to identify key nodes in the supply chain and analyze the partners involved and associated costs. We also identified the sales organization structures for each channel, including sales personnel, customer listing processes, and key metrics of onboarding channel partners.

Impact

The research helped the client in: Identifying optimal sales channels and partners in the industry Revamping the overall sales and distribution strategy for their premium personal care products and distribution models, guided by cost considerations

Benchmarking Digital Maturity and IT Operating Models

Objective & Scope

The client, a global consulting firm, wanted to evaluate digital maturity across leading Indian investment banks and firms offering private banking and advisory services. For this, it sought Benori’s support to: Map digital platform and application usage across business verticals, such as asset management, investment banking, institutional equities, and private wealth advisory, to benchmark adoption and integration levels across peers Identify tools used across functions, including marketing, HRMS, tech operations, customer experience, and other enterprise areas

Approach

For four shortlisted companies, we conducted in-depth expert interviews to gather insights on tools and platforms used across key functions and multiple business verticals. Questions covered IT spend, staffing, and budget allocation to understand overall IT resource distribution and investment priorities. This was complemented by comprehensive secondary research to analyze technology advancements, system integration, span of control, IT organizational structures, and other critical aspects of digital maturity.

Impact

Benori helped the client in the following areas: Identifying best-in-class tools and platforms used across core functions and business lines Evaluating digital maturity across peer institutions to highlight strengths and gaps in the technology stack Highlighting tech advancements and system integration approaches adopted by shortlisted companies to accelerate digital transformation

Examining the Dynamics and Challenges in Procurement Across Industries

Objective & Scope

The client, a consulting firm, was looking into the supply chain dynamics of US-based firms. It wanted to understand the procurement challenges faced by businesses and sought Benori’s support to: Assess the investment strategies of key industries in IT, focusing on software and hardware sectors Analyze current trends in procurement, new product development, and digital IT solutions Explore the challenges executives face in building resilient supply chains and integrating digital IT solutions into procurement and supply chain operations

Approach

Our approach involved identifying and selecting several global technology leaders from firms based in the United States with substantial revenue and geographic reach worldwide. Following the initial selection, participants were surveyed along key parameters such as procurement strategies, adoption of digital tools, supply chain resilience, vendor management practices, and cost optimization measures. The responses were then further curated to ensure relevance and data integrity.

Impact

The research helped the client in: Gaining valuable insights into building resilient supply chains customized to the specific needs of each industry Highlighting key areas for supply chain improvements across various sectors and guiding informed decision-making

Assessing the Availability of Trade Certifications Among Auto Part Suppliers

Objective & Scope

The client, a global consulting firm, wanted to understand the prevalence of export-oriented documentation in the auto ancillary supplier landscape. For this, it wanted Benori’s support in an evaluation exercise across Southeast Asia through the following activities: Interviewing auto parts suppliers across Southeast Asian countries to assess the availability of export and free trade-oriented forms and licenses Understanding the motivation and drivers leading to the decision to get certified for export and trade

Approach

We started with secondary research to understand the required forms and certifications for trade in Southeast Asia and the related impact on localization. Extensive primary research and expert consultations were conducted to gather insights from South Asian suppliers on the scope of coverage of these forms, their availability with vendors, and vendors' motivations for the applications.

Impact

The quick turnaround research helped the client to: Understand the sentiment of suppliers in South Asia towards import and export in the region Gain insights on the relevant forms and licenses as well as implications on localization Recognize supplier willingness to proactively obtain licenses as an indication of business growth

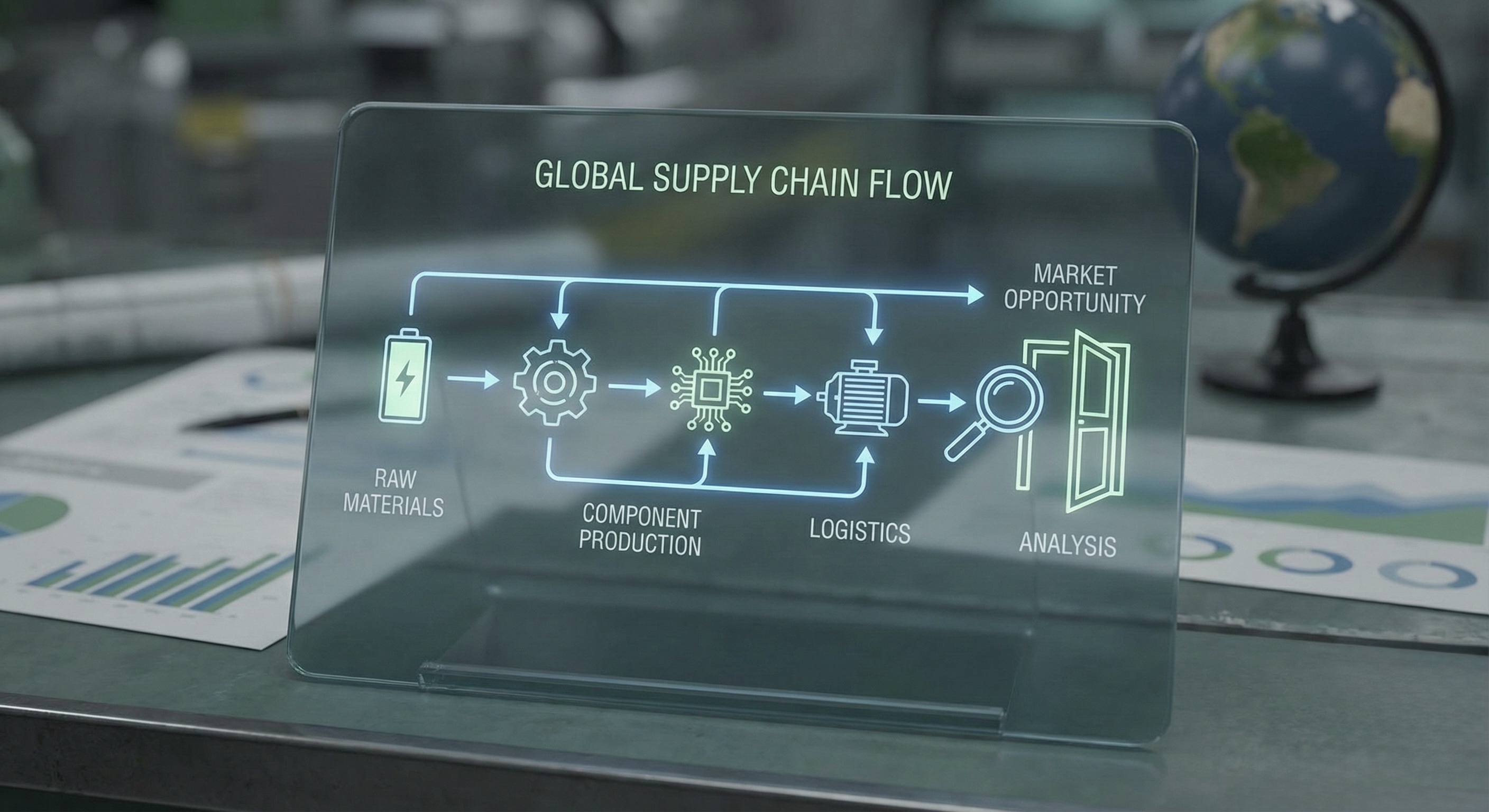

Assessing EV Component Supply Chain to Examine the Market Entry Opportunity

Objective & Scope

The client, a leading consulting firm, wanted to understand the dynamics of the electric vehicle (EV) component supply chain for OEMs. It sought Benori’s support to understand: Market landscape covering critical insights for the supply chain, covering tier 1 and tier 2 suppliers of the key automobile components Value chain understanding of electric vehicle components and their current and future suppliers with a significant presence in ASEAN countries. Future procurement, localization plans, partnerships, collaborations, government policies, and incentives Approach:

Approach

We conducted primary research by interviewing experts to collect information on the supply chain dynamics of the selected EV OEMs in the target geography, as well as multiple stakeholders, including company executives in the EV domain. We conducted secondary research by reviewing automobile and EV databases, industry publications, white papers, and press releases to collect data.

Impact

The research helped the client to: Understand the market potential of EV components, key government incentives, and policies expected to impact localization plans for EVs in selected ASEAN countries Understand the value chain of EV components, manufacturing, and assembling activities. Take actions on the insights and learnings to help in decision-making for market entry

Identifying Startup Partnerships to Enable Innovation in the Food and Feed Value Chain

Objective & Scope

The client, a leading industrial machinery manufacturing company, wanted to foster partnerships to drive food and feed value chain innovations. It was looking to explore collaboration opportunities with innovative Indian startups to enhance the food and feed ecosystem, and sought Benori's support to: Identify startups providing solutions in digitalization, sensors, innovative food production, and sustainability Outreach to these startups to promote participation in the client's start-up collaboration program

Approach

Our approach was to identify a long list of potential startups aligned with the client’s requirements. We evaluated the startups based on their capabilities and relevance to the areas of focus, creating concise profiles for the shortlisted candidates. To initiate engagement, we reached out to the startups through email, LinkedIn, and phone calls to inform them about the collaboration program.

Impact

The research helped the client in: Identifying startups offering cutting-edge solutions in digitalization, sensors, food production, and sustainability Increasing awareness of the collaboration program among innovative Indian startups, driving higher participation and engagement.

Identifying Potential Raw Materials and Suppliers of Water-Soluble Films

Objective & Scope

The client, a leading FMCG company, as part of its sustainability initiatives to adopt biodegradable ingredients, wanted to explore and assess renewable raw materials for water-soluble films or sheets from a technical perspective and to understand their various applications. For this, the client wanted Benori’s support to: Identify sources or ingredients that are being explored as film or sheets (functional films), primary packages, etc. Evaluate the process of making films or sheets Explore suppliers, manufacturers, and companies that use water-soluble functional films in their products Analyze the activities of competitors and other key players

Approach

We employed a problem-solving approach to analyze the technology behind renewable raw materials for water-soluble films and sheets, as well as their production methods. The information was gathered from patents, commercial products available in paid databases, company websites, news articles, and other sources. We then generated actionable next steps for the client by answering questions about current and future challenges.

Impact

The study helped the client gain a technical understanding that will ultimately aid in making strategic decisions for their sustainability initiatives related to: Renewable raw material or sources availability, challenges associated with them, their solutions, opportunities for specific ingredients, application areas, and functional properties Popular production methods and new processes to form films or sheets Collaboration with potential partners for the required technology and application

Evaluating R&D Strategies of FMCG Firms to Uncover Their Innovation Framework

Objective & Scope

The client, a leading FMCG company, was looking into their competitors' R&D and investment strategies. It wanted to understand their R&D efforts across multiple aspects, and sought Benori’s support to: Investment levels in R&D, including locations, models, and number of R&D centers and talent pool Identifying current and future R&D focus areas, including recent technological advancements, partnerships, etc.

Approach

To assess competitors’ R&D strategies, we leveraged public databases to capture patent filings, publications, and clinical trials to understand focus areas and upcoming innovations. Company reports and industry analysis provided insights into R&D investments, locations, talent acquisition, partnerships, and areas of excellence. We were also engaged with the company’s senior stakeholders for further validation.

Impact

The research helped the client: Gain insights into the areas where competitors are focusing on their R&D efforts To identify emerging technologies and potential threats or opportunities Take informed decisions about their own innovation pipeline, resource allocation, and potential partnerships

Technology, Product, and Partner Landscape of Sustainable Rigid and Flexible Packaging

Objective & Scope

The client, a global FMCG company, wanted to assess its readiness for sustainable packaging by looking at related dynamics in the space across industries. For this, it wanted Benori’s support in: Identifying technologies, products, and partners providing scalable solutions for rigid and flexible packaging Shortlisting solutions that are recyclable by design, environmentally compostable, have a low carbon footprint, and a zero fossil fuel feedstock approach

Approach

The research included information capturing around technologies, patents, products, and start-ups in the rigid and flexible sustainable packaging space. We looked for various universities and their research work in this field. Partner scouting was conducted through primary research to understand how these universities, start-ups, and other companies have invested in sustainable packaging and to gather insights to support the client’s requirements.

Impact

The research helped the client to take strategic business decisions towards capability building in: Superior recycled materials for rigids such as High-Density Polyethylene (HDPE), Polypropylene (PP), and Polyethylene Terephthalate (PET) Fully recyclable flexibles Non-persistent biodegradable flexibles

Assessing and Ranking Global Asset Management Companies on their ESG Focus

Objective & Scope

The client, a non-profit financial think tank, wanted to assess global financial asset management companies and financial institutions (FIs) on their commitment, policies, and actions to eliminate anti-environmental, social, and governance (ESG) activities from their investments. To assess these companies, the client sought Benori’s support to: Gather secondary data on each company and its investment policies and ESG focus Rate them according to a specific list of indicators and the parameters

Approach

We conducted extensive secondary research to understand the guidelines, policies, actions, and activities related to ESG for asset management companies. This required a deep analysis of publicly available information and media activities for these companies and their group companies to ascertain their ratings.

Impact

The report helped the client in: Understanding the commitment and focus of global asset managers towards ESG Gauge their level of commitment towards ESG and take decisions and advise companies on ways to achieve a net-zero financial system