Impact Stories

Our work speaks through results. From market entry strategies to competitive turnarounds, these stories showcase how our intelligence has powered real-world outcomes for global leaders.

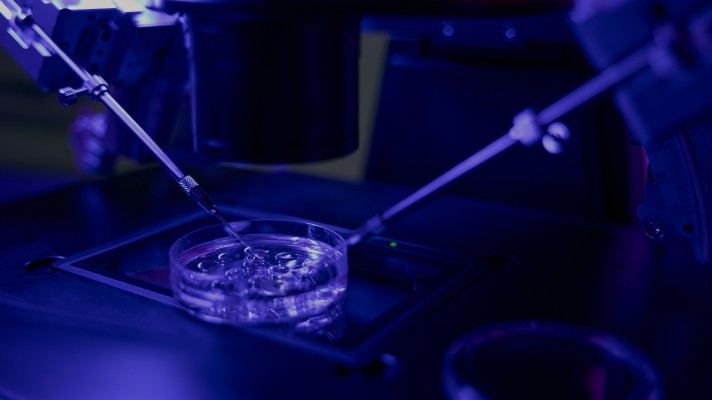

Assessing the Scope of Acquiring an In-Vitro Diagnostics (IVD) Business in India

Objective & Scope

The client, a professional services firm based in the Middle East, wanted to assess the scope of acquiring an in-vitro diagnostics (IVD) firm in India for its end client. For this, it sought Benori’s assistance in: Getting a holistic view of the current market dynamics and future potential of the IVD market in India for informed decision-making Understanding the competitive landscape and business models, operations, and strategies of the top players in the market

Approach

We conducted an extensive market study, encompassing both secondary and primary research. We approached key market participants on the demand and supply sides and conducted in-person interviews to understand business models and market dynamics.

Impact

The research findings enabled the end client to finalize its market entry strategy by providing insights into: Market landscape of IVD in India Key players in the market and business models adopted by them

Conducting Sentiment Analysis for Benchmarking Competitors

Objective and Scope:

The client, a consulting and advisory firm, wanted to assess brand perception and customer satisfaction and conduct a comparative benchmarking analysis of three companies. For this, it sought Benori's support in: Analyzing customer feedback, reviews, and ratings to identify key pain points and positive experiences Comparing customer perceptions across the selected companies to understand relative strengths and weaknesses Identifying opportunities for service enhancements and competitive differentiation

Approach:

Benori employed web scraping to collect customer feedback from platforms such as review sites and travel forums. Used GenAI capabilities, including LLMs, to analyze sentiment across the entire customer journey, from bookings to room services. Iterative prompt engineering was applied to refine sentiment classification into positive, negative, or neutral.

Impact:

The study enabled the client to Benchmark brand perception across three companies to understand competitive positioning Develop data-driven strategies to boost customer satisfaction and loyalty Enhance communication and marketing initiatives using sentiment trends and feedback analysis

Benchmarking Companies for a Global Venture Capital Firm

Objective & Scope

The client, a large, global venture capital firm, wanted to optimize the shortlisting of start-ups that could be profitable investment opportunities. For this, it sought Benori’s support in: Tracking growth indicators of 450+ companies in the enterprise technology and consumer space Highlighting outliers that could be explored for investment

Approach

Benori built an automated analytics pipeline that aggregated data from multiple digital and financial sources, including Crunchbase (funding, valuation, investors, employee growth), LinkedIn (hiring velocity), SimilarWeb (web traffic), and news APIs (mentions and sentiment) into Azure SQL, orchestrated via Azure Data Factory. Feature engineering derived key growth signals, including year-on-year (YoY) changes in employees, funding, valuation, traffic, hiring velocity, and sentiment trends, which were combined into a composite growth potential score. Anomaly detection flagged outperforming peers, and insights were visualized through a dashboard, enabling rapid identification of high-growth companies and emerging investment opportunities backed by real-time data.

Impact

The exercise enabled the client to: Make faster, data-driven investment decisions by automating start-up monitoring Highlight high-growth opportunities through a real-time analytics dashboard

Building a Centralized Dashboard for Regulatory Change Management in the F&B Industry

Objective & Scope

The client, a leading FMCG company, wanted to proactively track and manage regulatory changes impacting the food and beverages (F&B) industry in India. To achieve this, it sought Benori’s support in: Continuously monitoring regulations across food categories and themes, supported by automated alerts Creating a structured, central repository of regulatory data that provides a real-time view of upcoming changes and their timelines, and establishing an impact analysis framework for the identified regulations

Approach

Built a solution to continuously monitor regulations across various food categories and themes for regulatory change management in the F&B industry. Using Power BI with Microsoft Dataverse, the platform automatically captured updates from regulatory websites, enriched by analyst inputs. The system enabled users to view regulations, drill into details, add time-stamped comments, and track tasks in a single interface. Automated email alerts ensured real-time updates, creating a unified, actionable platform for regulatory tracking and management.

Impact

The integration of real-time regulatory tracking with a centralized, collaborative dashboard enabled the client to: Receive automated alerts for new or updated regulations Automatically assign tasks to relevant team members to streamline the compliance workflow Facilitate real-time impact analysis, allowing stakeholders to quickly assess and react to regulatory changes

Conducting a Product Mix Study for a Multinational Retail Company

Objective & Scope

The client, a leading multinational retail company that operates wholesale stores in India, wanted to review its product mix/assortment in select categories at a regional level with the objective of providing the right products at the right price to customers. For this, it sought Benori's support in conducting a comprehensive analysis: To understand the top-selling products and price points across market segments Regional and seasonal variations in demand Contribution of products to the overall sale

Approach

We collected data through primary interviews with B2B customers across segments such as Hotels, Restaurants, Caterers (HORECA), Offices & Institutions (O&I), distributors, and resellers. The data was collected from the five cities across the north, west, and south of India. We conducted an in-depth analysis of the regions and segments based on parameters such as product price points, preferred buying sources, and willingness to buy from cash-and-carry stores. The analysis was augmented by the inclusion of competitors and offerings.

Impact

The insights enabled the client to understand the following: The right product mix as per the market dynamics The top-selling products across various categories like houseware, tableware, and paper goods, along with their best price points Top reasons for customers not buying from client stores

Identifying Innovative Digital Business Models in the Retail Industry

Objective & Scope

The client, a consulting firm, was supporting a government entity in assessing digital business models in the retail industry, for instance, dark stores, autonomous stores, and peer-to-peer (P2P)/peer-to-merchant (P2M) platforms. It sought Benori’s support to: Identify and benchmark various business models, along with their functional and deployment processes Evaluate the types of interventions and regulations (in the form of policies and initiatives) that the governments are planning and implementing in the retail space

Approach

We created an exhaustive list of distinct and innovative business models. Based on their tech advancement, ROI, and regional fit, 11 business models were shortlisted. These were profiled in detail, outlining their technologies, key players, implementation sub-sectors, case examples, potential business impact, and implementation considerations. Additionally, we captured the government interventions, including those adopted and in the pipeline, across a list of countries

Impact

The research helped the client in: Assessing the feasibility of these models for businesses and evaluating their potential impact upon implementation Delivering actionable insights to the end client by synthesizing data on how various countries have adopted these business models

Conducting Value Chain Assessment of the Ketchup and Mayonnaise Market

Objective & Scope

The client, a leading player in the FMCG sector, sought to gain a comprehensive understanding of the best practices adopted by key players in the ketchup and mayonnaise market in India. The objective was to analyze the entire value chain, from raw material procurement to processing, packaging, and distribution, while gaining key operational insights. For this, they sought Benori’s support to: Assess the production process, including raw material procurement strategies, backward integration, manufacturing operations, packaging, technological sophistication, and the cost model Analyze market performance, covering sales, product mix, and distribution management with their associated costs

Approach

We conducted extensive desk and primary research to analyze the ketchup and mayonnaise value chain of selected players. This included evaluating procurement strategies, manufacturing and packaging operations, associated costs, sales, and distribution. We engaged with key stakeholders to gather insights on sourcing practices, production capacities, cost structures, product offerings, and technological adoption. This combined approach enabled us to validate findings, address data gaps, and provide actionable insights into the overall cost structure of these products.

Impact

The research helped the client in: Understanding the value chain of key players relating to ketchup and mayonnaise, associated cost of raw material and project management, conversion cost for specific pack types, as well as gross margins Understanding the overall distribution model, warehousing and logistics costs, and key channels served

Evaluating the Operations of a New Age Personal Care Player in India

Objective & Scope

The client, a leading CPG firm, wanted to understand the operations of a manufacturer of personal and baby care products. It wanted to assess its best practices across sales and distribution operations, and sought Benori’s support to: Analyze the player’s key sales and distribution channels and revenue in India Identify top consumption hubs, sales fulfilment models deployed, and promotion strategies Assess margin structures, turnaround time with channel partners, and associated costs

Approach

Our approach was to break down and study every sales channel and order fulfillment model for both online and offline sales. We conducted secondary research to identify key nodes in the supply chain and analyze the partners involved and associated costs. We also identified the sales organization structures for each channel, including sales personnel, customer listing processes, and key metrics of onboarding channel partners.

Impact

The research helped the client in: Identifying optimal sales channels and partners in the industry Revamping the overall sales and distribution strategy for their premium personal care products and distribution models, guided by cost considerations

Predicting and Preventing Customer Churn through Machine Learning Analytics

Objective and Scope:

The client, an e-commerce retailer, sought to develop a predictive analytics framework to identify customers at high risk of churn. The engagement aimed to support strategic decision-making through: Identify at-risk customer segments using machine learning models to predict churn likelihood across customer cohorts, with focus on behavioral patterns and engagement metrics Quantify churn drivers and patterns across customer acquisition channels, subscription plans, feature adoption, and support interactions to enable targeted intervention strategies

Approach:

Benori combined automated data extraction from CRM systems and transaction logs with advanced machine learning to identify and rank churn predictors. Custom Python scripts were developed to aggregate customer behavioral signals (usage frequency, support interactions, payment delays) and engineer predictive features. Leveraging gradient boosting and ensemble modeling techniques, Benori trained multiple models to classify churn probability, cross-validated results with business rules, and created a structured dataset ready for real-time churn scoring and dashboard deployment.

Impact:

The study enabled the client to: Achieve early churn detection by assigning propensity scores to every active customer, enabling the commercial team to prioritize at-risk accounts for targeted retention campaigns Enable data-driven retention strategies through identification of key behavioral signals and root cause analysis, allowing to proactively address pain points

Conducting As-Is Assessment of a Bank for Insurance Monitoring Solution

Objective & Scope

The client, a leading commercial bank, sought to automate insurance covenant monitoring and compliance processes. The engagement aimed to: Evaluate and redesign insurance monitoring processes through assessment of current workflows, data sources, and compliance controls to identify automation opportunities and high-risk pain points Develop an automated monitoring solution with proactive alerts for expiring/lapsed policies, inadequate coverage, and non-compliance, enabling real-time portfolio visibility and exception management

Approach

Benori deployed a structured 3-phase agile methodology combining process assessment, solution design, and implementation. The evaluation phase mapped manual workflows and benchmarked them against industry practices. Solution design developed an automated monitoring architecture with data integration pipelines connecting loan, property, and insurance systems, incorporating COI tracking, automated alerts, and centralized data repositories. Implementation deployed dashboards with real-time compliance monitoring and configured rules engines for triggering alerts on policy expiries and covenant breaches.

Impact

The study enabled the client to: Eliminate operational inefficiencies by reducing manual policy review workload by automating certificate tracking and expiry monitoring across the entire CRE portfolio while improving compliance accuracy Enhance portfolio risk visibility through real-time monitoring dashboards, enabling proactive identification of coverage gaps and policy lapses

Examining the Dynamics and Challenges in Procurement Across Industries

Objective & Scope

The client, a consulting firm, was looking into the supply chain dynamics of US-based firms. It wanted to understand the procurement challenges faced by businesses and sought Benori’s support to: Assess the investment strategies of key industries in IT, focusing on software and hardware sectors Analyze current trends in procurement, new product development, and digital IT solutions Explore the challenges executives face in building resilient supply chains and integrating digital IT solutions into procurement and supply chain operations

Approach

Our approach involved identifying and selecting several global technology leaders from firms based in the United States with substantial revenue and geographic reach worldwide. Following the initial selection, participants were surveyed along key parameters such as procurement strategies, adoption of digital tools, supply chain resilience, vendor management practices, and cost optimization measures. The responses were then further curated to ensure relevance and data integrity.

Impact

The research helped the client in: Gaining valuable insights into building resilient supply chains customized to the specific needs of each industry Highlighting key areas for supply chain improvements across various sectors and guiding informed decision-making

Conducting Customer Satisfaction Study for an Online Innerwear Brand

Objective & Scope

The client, a leading online retailer of innerwear, sought to deepen its understanding of customer preferences and experiences across the innerwear purchase journey. It engaged Benori to combine customer analytics with primary research to generate a comprehensive view of buying behavior. The scope included analyzing an existing set of customer data provided by the client and augmenting it with a customer perception survey to triangulate insights on: Overall preferences of Indian women across color, pattern, fabric, and usage occasion City-wise and regional variations in lingerie buying behavior

Approach

Benori adopted a mixed-method approach that integrated customer analytics with primary survey research. Historical customer data shared by the client was analyzed to identify patterns in browsing, purchase, and category preferences. These findings were validated and enriched through a detailed customer perception survey focused on purchase drivers, brand expectations, and value-added features. Insights from both data sources were triangulated to ensure robustness and presented through intuitive infographics and insight-led narratives.

Impact

The combined analytics and survey-led insights enabled the client to: Surface nuanced and data-backed insights, including engaging fun facts, on innerwear preferences across regions and customer segments in India Use customer education and insight-led storytelling to influence future buying behavior and strengthen brand engagement

Assessing the Availability of Trade Certifications Among Auto Part Suppliers

Objective & Scope

The client, a global consulting firm, wanted to understand the prevalence of export-oriented documentation in the auto ancillary supplier landscape. For this, it wanted Benori’s support in an evaluation exercise across Southeast Asia through the following activities: Interviewing auto parts suppliers across Southeast Asian countries to assess the availability of export and free trade-oriented forms and licenses Understanding the motivation and drivers leading to the decision to get certified for export and trade

Approach

We started with secondary research to understand the required forms and certifications for trade in Southeast Asia and the related impact on localization. Extensive primary research and expert consultations were conducted to gather insights from South Asian suppliers on the scope of coverage of these forms, their availability with vendors, and vendors' motivations for the applications.

Impact

The quick turnaround research helped the client to: Understand the sentiment of suppliers in South Asia towards import and export in the region Gain insights on the relevant forms and licenses as well as implications on localization Recognize supplier willingness to proactively obtain licenses as an indication of business growth

Assessing EV Component Supply Chain to Examine the Market Entry Opportunity

Objective & Scope

The client, a leading consulting firm, wanted to understand the dynamics of the electric vehicle (EV) component supply chain for OEMs. It sought Benori’s support to understand: Market landscape covering critical insights for the supply chain, covering tier 1 and tier 2 suppliers of the key automobile components Value chain understanding of electric vehicle components and their current and future suppliers with a significant presence in ASEAN countries. Future procurement, localization plans, partnerships, collaborations, government policies, and incentives Approach:

Approach

We conducted primary research by interviewing experts to collect information on the supply chain dynamics of the selected EV OEMs in the target geography, as well as multiple stakeholders, including company executives in the EV domain. We conducted secondary research by reviewing automobile and EV databases, industry publications, white papers, and press releases to collect data.

Impact

The research helped the client to: Understand the market potential of EV components, key government incentives, and policies expected to impact localization plans for EVs in selected ASEAN countries Understand the value chain of EV components, manufacturing, and assembling activities. Take actions on the insights and learnings to help in decision-making for market entry

Identifying Procurement Trends for Liposomal, Lipid, and Conventional Amphotericin B

Objective & Scope

The client, a boutique consulting firm, was trying to identify trends in government and state-driven procurement of Amphotericin B before and after the black fungus outbreak in India across various forms. It sought Benori's support to: Analyze the patient and treatment areas for Amphotericin B in various forms Understand the change in procurement practices of state and central government entities before and after the black fungus outbreak

Approach

We started by conducting extensive secondary research on tenders issued by government entities, state and central, as well as public health channels that procure the drug through general tenders. We also examined significant changes driven by the outbreak and the allocation of Amphotericin B in response to it. We looked at other conventional anti-fungal drugs and their procurement for benchmarking the drugs.

Impact

The research findings helped the client in: Understanding the total market size and unmet demand for Amphotericin B in India Identifying the underserved therapy areas that could be potential markets for new entrants manufacturing Amphotericin B

Identifying Startup Partnerships to Enable Innovation in the Food and Feed Value Chain

Objective & Scope

The client, a leading industrial machinery manufacturing company, wanted to foster partnerships to drive food and feed value chain innovations. It was looking to explore collaboration opportunities with innovative Indian startups to enhance the food and feed ecosystem, and sought Benori's support to: Identify startups providing solutions in digitalization, sensors, innovative food production, and sustainability Outreach to these startups to promote participation in the client's start-up collaboration program

Approach

Our approach was to identify a long list of potential startups aligned with the client’s requirements. We evaluated the startups based on their capabilities and relevance to the areas of focus, creating concise profiles for the shortlisted candidates. To initiate engagement, we reached out to the startups through email, LinkedIn, and phone calls to inform them about the collaboration program.

Impact

The research helped the client in: Identifying startups offering cutting-edge solutions in digitalization, sensors, food production, and sustainability Increasing awareness of the collaboration program among innovative Indian startups, driving higher participation and engagement.

Identifying Potential Raw Materials and Suppliers of Water-Soluble Films

Objective & Scope

The client, a leading FMCG company, as part of its sustainability initiatives to adopt biodegradable ingredients, wanted to explore and assess renewable raw materials for water-soluble films or sheets from a technical perspective and to understand their various applications. For this, the client wanted Benori’s support to: Identify sources or ingredients that are being explored as film or sheets (functional films), primary packages, etc. Evaluate the process of making films or sheets Explore suppliers, manufacturers, and companies that use water-soluble functional films in their products Analyze the activities of competitors and other key players

Approach

We employed a problem-solving approach to analyze the technology behind renewable raw materials for water-soluble films and sheets, as well as their production methods. The information was gathered from patents, commercial products available in paid databases, company websites, news articles, and other sources. We then generated actionable next steps for the client by answering questions about current and future challenges.

Impact

The study helped the client gain a technical understanding that will ultimately aid in making strategic decisions for their sustainability initiatives related to: Renewable raw material or sources availability, challenges associated with them, their solutions, opportunities for specific ingredients, application areas, and functional properties Popular production methods and new processes to form films or sheets Collaboration with potential partners for the required technology and application

Conducting Pricing Intelligence of Dental Clinics across the United Kingdom

Objective & Scope

The client, a UK-based dental clinic, wanted to understand the private pricing for 12 specific dental treatments offered by its competitors across its clinic locations in the United Kingdom. For this, it sought Benori’s support to: Create a list of competitors, working around its ~380 locations, and map the largest competitors based on their reviews and services Conduct secondary research on selected competitors to understand the price points of the treatments specified

Approach

Mapped a list of around ~380 clinic locations by leveraging geospatial data in Google Maps through automation Applied automated web intelligence workflows to visit the websites of selected competitors and identify their pricing-related sections and procedure fees Created a standardized pricing dataset for 12 treatment procedures using LLMs by standardizing extracted information across clinics to enable accurate like-for-like comparisons Delivered a benchmarking dashboard summarizing price trends across competitor clinics

Impact

The detailed insights helped the client to: Gain an understanding of the treatment timelines, delivery formats, and payment terms of the competitors Conduct a pricing analysis of competitors across each strategic dental clinic location to develop business development strategies

Conducting Commercial Due Diligence of a Leading NBFC for a Potential Investment

Objective & Scope

The client, a global investment firm, sought to evaluate a leading non-banking financial company’s (NBFC) brand equity, operational efficiency, credit approach, and competitive positioning, as part of its commercial diligence process for a potential investment. For this, it sought Benori’s support to: Assess the NBFC’s functional performance and brand equity, including perceptions around product fit, credit flexibility, turnaround times, payout structures, and the effectiveness of its tech infrastructure Benchmark the NBFC against peer lenders to understand their competitive edge, differentiators resonating in the market, and existing gaps or opportunities for improvement

Approach

In-depth interviews were conducted across five metro cities, with key on-ground stakeholders, including direct selling agents (DSAs), the NBFC’s sales managers, and competitor bank/NBFC branch managers. The survey explored product experience, turnaround times, credit flexibility, tech adoption, and brand perception of the stakeholders. Also, NBFCs were compared to peers to interpret service efficiency, partner support, and overall market positioning. Insights were drawn from real case examples shared by respondents, offering a grounded view of day-to-day lending dynamics.

Impact

Benori helped the client in the following areas: Validated brand and operational performance through frontline feedback, offering a grounded view of the NBFC’s agility, credit flexibility, and service consistency as experienced by on-ground stakeholders across key metros Identified competitive gaps and differentiation levers, enabling the client to benchmark the company against peer NBFCs, assess retention risks, and uncover opportunities for process improvement and partner engagement

Advisory on Analytics Strategy Development of a Retail Bank

Objective & Scope

The client, a commercial bank, sought to develop a comprehensive data and analytics strategy to enable data-driven decision-making. The engagement aimed to: Define analytics roadmap and use cases through stakeholder engagement across executive leadership, business units, and technology teams to identify high-impact opportunities aligned with business priorities Design future-state data architecture encompassing current state assessment, gap analysis, and scalable architecture design to support advanced analytics and risk management

Approach

Benori deployed a structured 4-phase methodology combining stakeholder discovery, use case prioritization, architecture design, and implementation roadmapping. The CRUISE framework was applied to evaluate 15-20 use cases across six dimensions. Technical assessments of data sources, infrastructure, and analytics capabilities formed the foundation for designing a five-layer future-state architecture with vendor recommendations and gap remediation plans, culminating in an 18-36 month phased implementation roadmap.

Impact

The study enabled the client to: Enable data-driven decision making, creating a foundation for AI/ML and advanced analytics capabilities that accelerate innovation and market responsiveness Drive operational efficiency gains through automated processes and systematic data quality improvements, reducing operational costs by 20-30% while establishing faster time-to-insight through self-service analytics capabilities

Providing a 360° View of Life Insurance Business in an Automated Single Interface

Objective & Scope

The client, a leading private life insurer in India, wanted to optimize the data collection process from the life insurance public disclosure portal and develop a single application that provides a 360-degree view of the KPIs for the industry and its competitors. For this, it sought Benori’s support in: Automating the quarterly data collection process Developing an interactive dashboard to visualize data for tracking indicators quarterly and identifying areas that have scope for improvement

Approach

Built an end-to-end Power BI application to give the client a 360° view of the life insurance business in a single automated interface. The solution consolidated competitor KPIs such as premiums and expenses, supported by a structured solution design, data enablement, and visualization. Data from PDFs was automatically ingested into an Azure SQL Database for real-time insights, while Azure Functions enabled news integration via a hosted scraper. Governance and security were ensured through Page-Level Security with role-based access for different user groups.

Impact

The solution enabled the client to: Reduce the strategy team’s effort by 85% through the machine-driven approach and interactive user interface Establish a single source of truth for all data use cases, streamlining sales meetings, MIS/reporting, and internal discussions

Conducting Sales Enablement Study for the Packaging Market in South Korea

Objective & Scope

The client, a boutique strategic consulting firm, wanted to understand the label and packaging market in South Korea for a multinational IT company (the ‘end client’) that wanted to offer its digital printing solutions in that market. For this, it sought Benori’s support for sales enablement and help with the following: Generating lists of converters in label, flexible packaging, and folding carton segments Profiling the selected converters across the three target segments Conducting a deep dive study on the shortlisted companies

Approach

We undertook extensive primary and secondary research and conducted the study in two phases. In phase one, we identified and profiled 110 companies across the three segments, while in phase two, we created deep-dive profiles of the companies shortlisted by the client. We used native-language speakers to conduct primary interviews in both phases to obtain the required information.

Impact

The research helped the end client in getting: Lists of converters across the three segments in South Korea In-depth insights on converters in these segments and their perceptions of the client's brand versus competitor brands A list of potential sales leads to enable business development efforts

Identifying Strategic Buyers for Water and Sewage Treatment Plants in India

Objective & Scope

The client sought to divest its Water and Sewage Treatment Plants (WTP and STP) in Karnataka, Mohali, and Delhi, and has enlisted Benori’s support to identify potential buyers. The objective was to: Target infrastructure companies and those looking to expand their capacity in WTP and STP operations Focus on identifying prospects in these regions, providing company details, and leveraging secondary research from government websites, industry reports, and company sources to support strategic decision-making

Approach

Benori conducted a targeted analysis to identify potential buyers for the client's Water and Sewage Treatment Plants in Delhi, Mohali, and Karnataka. The research focused on infrastructure companies and operators looking to expand their WTP and STP capacity. Using secondary research, Benori explored government and industry sources, company reports, and market insights to provide a comprehensive overview of prospective buyers, including their contact details and strategic insights to support the client's divestment decision-making.

Impact

The research assisted the client with: Identifying potential buyers for their Water Treatment and Sewage Treatment Plants across key regions Gathering insights into infrastructure companies and existing operators in the water treatment sector, enabling targeted outreach Informed decision-making to enhance their divestment process effectively

Creating a CRM Database to Track Opportunities for a Healthcare Investor

Objective & Scope

The client, a UK-based investor specializing in the healthcare and life sciences sector, was looking to track and profile its potential target companies and partners. It wanted to develop a comprehensive database and sought Benori’s support to: Review and augment information on existing target companies Review and augment information on service providers, including individual industry experts, professional advisors, lenders, limited partners (LPs), and general partners (GPs)

Approach

Our approach was to consolidate the contacts and leads lists and categorize them to identify information gaps. We then conducted secondary research through company websites, reports, and third-party databases to track, verify, and augment client data requirements. The collated data was prepared to help track and profile potential partners, suppliers, and competitors.

Impact

The research helped the client in: Developing a detailed client database and classifying its portfolio to identify sector-relevant clients Implementing a one-stop platform to search for any potential company or contact across all service lines

Assessing opportunities in Digital Healthcare market in Middle East

Objective & Scope

The client, a leading hospital chain, wanted to expand its digital offerings in a Middle East country by developing a user-centric, digital-first healthcare platform. For this, they sought Benori’s support to: Evaluate the digital healthcare market, focusing on telehealth, m-health, and e-pharmacy initiatives Analyze factors affecting patient engagement, satisfaction, and adoption barriers Assess competitive dynamics and identify key players, service offerings, pricing, and value propositions across segments

Approach

We evaluated the digital healthcare segments and assessed their sizes to identify potential opportunities. We surveyed customers and businesses to understand their pain points and requirements. We conducted secondary research to understand the competitive landscape, including key players such as hospitals and telehealth platforms. We benchmarked them based on their digital offerings, levels of adoption, and customer ratings.

Impact

The detailed insights helped the client in: Developing a strategy to explore the digital space and capitalize on the identified opportunities Addressing the challenges highlighted in the study faced by their clients Assessing key players’ market positions in the digital landscape and identifying ways to enhance their current offerings and add new ones

Conducting Opportunity Assessment for a Leading Bank

Objective & Scope

The client, a leading private bank, wanted to conduct an in-depth assessment of the opportunity areas for its services. It sought Benori’s support in understanding: Market and industry growth trends for private banking services for the high-net-worth individuals (HNIs) segment Competitive landscape of 7-8 leading players Consumer needs gaps

Approach

We conducted in-depth secondary research to understand the competitor landscape, HNIs, and trends in the movement of India’s wealth and their drivers, growth prospects, and investment inclinations. We conducted primary research, including interviews with industry experts, affluent individuals, and HNIs, to understand their investment-making journeys and expectations.

The detailed insights helped the client in: Understanding the total addressable market for its services Assessing competitors’ business model, service offerings, strategy, positioning, focus, distribution/service channel Consumers’ views and perceptions towards the investment solutions and wealth services offered in the market

Creating a Report on the GCC Education Sector for an Investment Banking Advisory

Objective & Scope

The client, an investment banking advisory firm, wanted to create a detailed market report for the education sector across the GCC region. For this, it wanted Benori’s support to: Understand the market landscape covering market size, drivers, trends, challenges, as well as the competitive landscape of the education sector, including pre-primary, primary, secondary, and tertiary education segments Assess the opportunities and potential in the sector Create short one-pager profiles of top universities/colleges covering curricula offered, recent developments, etc.

Approach

We conducted extensive secondary research to gather information on market size, trends, and key players in the sector. We then created a data model to estimate the school-age population and the number of enrolled students across pre-primary, primary, secondary, and tertiary education in the GCC. We also provided insights into the impact of COVID-19 on the sector and the role of the latest technologies, such as AI and IoT, across the region.

Impact

The research report helped the client in: Validating its understanding of the market, which entailed the size of the market, trends, drivers, and challenges Enabling it to take strategic decisions after understanding the impact of COVID-19 on the sector

Identifying and Profiling Prospects for Business Development

Objective & Scope

The client, a Dubai-based investment banking advisory firm, wanted to identify the top 50 Indian companies operating in Africa and the top commodity traders headquartered in India for its business development initiatives. For this, it wanted Benori’s support in: Preparing a comprehensive list of product-based Indian companies with African operations, as well as a list of Indian commodity traders Identifying information on financials, operations in Africa, exports/imports, regional leadership, and others

Approach

We conducted extensive secondary research to prepare two separate lists of companies covering industries such as automotive, oil and gas, chemicals, FMCG, and pharmaceuticals. We reviewed various sources, including company websites, annual reports, press releases, LinkedIn, Factiva, and Eximpulse, to obtain the required information.

Impact

The study, completed within two business weeks, helped the client generate potential leads in the region, which it planned to reach out to for its business development initiatives.

Benchmarking Digital Maturity and IT Operating Models

Objective & Scope

The client, a global consulting firm, wanted to evaluate digital maturity across leading Indian investment banks and firms offering private banking and advisory services. For this, it sought Benori’s support to: Map digital platform and application usage across business verticals, such as asset management, investment banking, institutional equities, and private wealth advisory, to benchmark adoption and integration levels across peers Identify tools used across functions, including marketing, HRMS, tech operations, customer experience, and other enterprise areas

Approach

For four shortlisted companies, we conducted in-depth expert interviews to gather insights on tools and platforms used across key functions and multiple business verticals. Questions covered IT spend, staffing, and budget allocation to understand overall IT resource distribution and investment priorities. This was complemented by comprehensive secondary research to analyze technology advancements, system integration, span of control, IT organizational structures, and other critical aspects of digital maturity.

Impact

Benori helped the client in the following areas: Identifying best-in-class tools and platforms used across core functions and business lines Evaluating digital maturity across peer institutions to highlight strengths and gaps in the technology stack Highlighting tech advancements and system integration approaches adopted by shortlisted companies to accelerate digital transformation

Understanding the UK Litigation and Dispute Trends Market Across Five Trending Themes

Objective & Scope

The client, a US-based corporate law firm, wanted to evaluate the UK litigation and dispute trends market. To support this effort, the firm engaged Benori’s support in: Identifying emerging dispute trends across five key themes, relevant regulatory developments, and key activities of peer law firms Provide insights into how disputes are typically addressed/resolved in the UK market

Approach

Benori worked closely with the client, reviewed the UK legal market structure, and assessed macroeconomic and regulatory factors. Also, we examined prevailing dispute resolution mechanisms in the UK, including litigation, arbitration, and alternative dispute resolution pathways. Further findings were combined across themes to provide a synthesis of opportunities and challenges for a mid-sized US law firm entering the UK market.

Impact

The detailed insights enabled the client to: Gain a clear, data-driven understanding of the UK litigation and dispute resolution landscape, supporting informed strategic decision-making Understand key insights on five critical practice areas, including peer firms’ positioning and emerging dispute trends, to identify high-potential expansion opportunities

Evaluating AI-powered Proposal Software Providers for a Legal Firm

Objective & Scope

The client, a legal consulting firm, wanted to identify and evaluate leading software companies offering AI-driven proposal solutions for legal applications. They sought Benori’s support to: Assess existing solutions for enhancing, automating, and generating proposals, RFP responses, bids, and pitches Identify the most relevant companies serving legal and professional firms Evaluate the shortlisted solution providers across capabilities, innovation, user experience, and pricing

Approach

Our approach was to identify the top companies providing proposal software and shortlist them based on key criteria such as AI-enabled features, focus on legal or professional firms, and availability of success stories. We profiled these companies, detailing their software capabilities, recognition, pricing plans, and case studies. Additionally, we created an executive summary to highlight the key differences and relevance to the client.

Impact

The research helped the client in: Identifying the most relevant AI-driven proposal solution providers tailored to legal and professional services Gain deeper insights into each provider’s offerings and market positioning through analysis of features, reviews, and industry recognitions

Supporting a Legal Tech Startup in Understanding Commercial Airlines Industry Landscape

Objective & Scope

The client, a legal tech startup, wanted to understand the current landscape of the global and US commercial airline industry to identify opportunities for legal work. For this, it sought Benori’s support in the following areas: Cover the current state of the commercial airline industry, along with recent developments, emerging themes, and sector outlook Briefly profile key players in the US commercial airline sector

Approach

We assessed and analyzed the global and US airline industries, covering market size (current and forecast), industry dynamics (drivers, challenges), and industry trends (tech and legal) to identify opportunities for legal work for the client. We covered key players operating in the US airline industry, including key facts, recent legal developments/lawsuits, strategic focus and initiatives, and outlook.

Impact

The engagement helped the client in Understanding recent developments in the sector to keep its sales and legal team informed Identifying opportunities for legal work through identified industry trends

Profiling Key Executives of Private Equity and Legal Firms

Objective & Scope

The client, a US-based corporate law firm, sought Benori’s support to profile private equity firms and competitor law firm executives to understand the following: Overview of their position, roles, and responsibilities in their current organization, along with the area of expertise and practice Coverage of key activities in which the executives participated, including speaking engagements, panel discussions, conferences attended, media appearances, and others

Approach

The study was conducted through extensive secondary research and focused on gathering information about executives at private equity firms. We explored the company websites, LinkedIn profiles, paid databases, and other credible secondary sources to gather insights on the executives. The information was collated through desk research and consolidated to generate relevant insights.

Impact

The research supported the client in: Identifying the key domains and practice areas that are crucial in propelling the business forward Targeting events and platforms that can be leveraged for professional engagements, where the firm can present its opinion on the relevant subject matter and expand its network

Conducting Comprehensive SKU Data Management for a US-Based Chemical Supplier

Objective & Scope

A US-based supplier of composite materials, fiberglass reinforcements, chemicals, and consumables in North America is modernizing its business operations by implementing a new enterprise resource planning (ERP) system and enhancing its online product catalog. For this, they wanted Benori’s assistance in data enrichment of ~70,000 stock keeping units (SKUs) of their own and partners’ products. The task included: Consolidating and simplifying their database and elevating their product portfolio Updating the material attributes of their products, available SKUs, and variants, and adding descriptive notes on products in a revised database that could be easily fed into their ERP systems

Approach

Our approach used data from tax deducted at source (TDS) information, company websites, product catalogs, etc., to interpret product descriptions. The relevant attributes or features were enriched and validated using the pre-defined framework in consultation with the client. The project was executed over 12 months, with two to three weekly alignment calls and quarterly governance calls to review the output and address any bottlenecks.

Impact

The research helped the client in: Keeping their business process and product documentation up-to-date Streamlining their digitalization efforts, specifically their online presence Increasing sales through the online channel

Identifying Growth Opportunities for Professional Services in the Middle East

Objective & Scope

The client, a leading professional services firm, wanted to identify opportunities to diversify its offerings and craft growth strategies for businesses in the Middle East over the next three to five years. It sought Benori’s support to: Assess key regional sectors, focusing on financial services, digital transformation and AI, sports, entertainment and tourism, and tax services Evaluate regional demands and identify strategic opportunities to develop targeted approaches for market diversification and long-term growth

Approach

Our approach involved analyzing sub-segments in each sector to evaluate strategies, trends, drivers, challenges, and key players, estimating market size, and identifying best practices. We provided insights into market trends and advisory service needs from a demand perspective. Competitive intelligence was utilized to benchmark key players across service lines and strategies.

Impact

The research helped the client in: Identifying growth opportunities by analyzing success factors and addressing ecosystem challenges with tailored mitigation strategies Providing actionable insights to shape effective growth strategies across key regional areas Understanding the competition to make informed decisions and enhance strategic positioning

Supporting a Consulting Firm with a Thought Leadership Report for the TMT Sector

Objective & Scope

The client, a consulting firm, wanted a thought-leadership report on the impact of generative AI (GenAI) on the technology, media, and telecom (TMT) sector to support its outreach initiative. It sought Benori’s support to capture insights and perspectives from CXOs within the TMT sector on their GenAI adoption journey, including challenges faced and the impact on operations, services, and governance.

Approach

We surveyed 100 CXOs from the TMT sector in India to gauge their perspective on the implementation and impact of the technology. We conducted secondary research to strengthen the report with the latest trends and initiatives. We compiled the survey results using graphs, pie charts, and other visual tools to convey the status of execution, implementation strategies, use cases, considerations, and challenges associated with the adoption of GenAI technology.

Impact

The engagement helped the client in creating a report that: Highlighted the latest trend in adoption, use case, and roadmap for implementation of GenAI in the TMT domain Improve its market presence and attract new business opportunities

Assessing the Dairy and Camel Milk Market in the Middle East

Objective and Scope

The study's objective was to evaluate the market potential for camel milk and related products within the domestic market and identify opportunities for export expansion. The research assessed consumer preferences, market trends, and product development prospects to support strategic decisions on new market entries and business growth.

Approach

We conducted desk research to analyze the market trends, trade data, and growth potential across key global markets. We then conducted a consumer survey in the country to capture preferences and purchasing behavior. All insights were validated and triangulated through expert consultations with industry stakeholders, including producers, distributors, and nutrition specialists. This triangulation method comprehensively provided a holistic view of demand, product potential, and strategic directions for market expansion and exports.

Impact

The research helped the client gain actionable insights into consumer behavior, emerging product demand, and export-friendly markets, including China, the United States, and Europe. It highlighted marketing and distribution strategies, such as modern trade activation and product diversification, enabling the client to position their brand effectively for growth and capitalize on domestic and global opportunities.

Assessing the Retail Food Market in the UAE

Objective and Scope

The client, a Dubai-based boutique advisory firm, was working with a leading food retailer (the ‘end client’) that wanted to understand the UAE food market and further assess the opportunity landscape. For this, it wanted Benori’s support to understand the following: Overall market size and competitive landscape of the retail food market Market share by food categories – fresh food versus packaged food Market size split by channel – retail versus distributor

Approach

We conducted secondary research to gather information on market size, trends, key players, and insights related to sourcing countries for the import and export of food categories. We conducted primary and expert interviews to gather insights into the value chain and stakeholders in the fresh and packaged food supply chains, as well as the market positioning of top food retailers based on their presence, store count, and market share.

Impact

The research helped the end client in taking strategic business decisions by providing the following insights: Market landscape and value chain for the retail food market Overall market size and market share of key players based on the categories Market positioning of top food retailers

Evaluating R&D Strategies of FMCG Firms to Uncover Their Innovation Framework

Objective & Scope

The client, a leading FMCG company, was looking into their competitors' R&D and investment strategies. It wanted to understand their R&D efforts across multiple aspects, and sought Benori’s support to: Investment levels in R&D, including locations, models, and number of R&D centers and talent pool Identifying current and future R&D focus areas, including recent technological advancements, partnerships, etc.

Approach

To assess competitors’ R&D strategies, we leveraged public databases to capture patent filings, publications, and clinical trials to understand focus areas and upcoming innovations. Company reports and industry analysis provided insights into R&D investments, locations, talent acquisition, partnerships, and areas of excellence. We were also engaged with the company’s senior stakeholders for further validation.

Impact

The research helped the client: Gain insights into the areas where competitors are focusing on their R&D efforts To identify emerging technologies and potential threats or opportunities Take informed decisions about their own innovation pipeline, resource allocation, and potential partnerships

Assessing Sustainability Initiatives of a Major CPG Player for Business Impact

Objective & Scope

The client, a leading FMCG player, was looking to understand the CPG industry's sustainability initiatives. It wanted to focus on CPG firms in APAC in the personal care space, and sought Benori’s support to: Understand the overall sustainability agenda, including key goals and timelines Examine sustainability measures across the value chain, covering R&D, product development, manufacturing, packaging, logistics, and distribution Analyze the impact of these sustainability measures on the competitor’s overall performance

Approach

Our approach was to conduct a competitive intelligence exercise using secondary, primary, and expert consultations. We identified the key pillars of the competitor’s sustainability agenda and detailed the initiatives implemented across the personal care value chain in APAC. Additionally, we analyzed key enablers of these initiatives, their performance impact, and future sustainability strategies.

Impact

The study enabled the client in: Understanding the competitor’s sustainability strategy and approach across the personal care value chain Identifying key enablers for implementing consumer-centric sustainability initiatives Assessing the impact of these initiatives on the competitor’s overall performance

Assessing the Scope of Acquiring an In-Vitro Diagnostics (IVD) Business in India

Objective & Scope

The client, a professional services firm based in the Middle East, wanted to assess the scope of acquiring an in-vitro diagnostics (IVD) firm in India for its end client. For this, it sought Benori’s assistance in: Getting a holistic view of the current market dynamics and future potential of the IVD market in India for informed decision-making Understanding the competitive landscape and business models, operations, and strategies of the top players in the market

Approach

We conducted an extensive market study, encompassing both secondary and primary research. We approached key market participants on the demand and supply sides and conducted in-person interviews to understand business models and market dynamics.

Impact

The research findings enabled the end client to finalize its market entry strategy by providing insights into: Market landscape of IVD in India Key players in the market and business models adopted by them

Benchmarking Distribution Channels for FMCG Products

Objective & Scope

Benori was tasked with identifying key FMCG categories in CSD, benchmarking CSD against GT and MT on discounts, schemes, and margins, and evaluating cost drivers influencing final product pricing across channels.

Approach

Benori mapped SKUs across CSD, GT, and MT, analysed channel value chains, and captured margins, schemes, and seasonal effects using secondary research supported by primary interviews with multiple distribution stakeholders.

Impact

Our research helped the client analyze all three channels and understand: The discounts given to the end customers in the CSD channel for all the categories How the net realization on maximum retail prices (MRPs) is helping companies gain profits despite having discounts and offers Comparison of margins and offers on specific categories available across CSDs with those of GT and MT

Assessing and Ranking Global Asset Management Companies on their ESG Focus

Objective & Scope

The client, a non-profit financial think tank, wanted to assess global financial asset management companies and financial institutions (FIs) on their commitment, policies, and actions to eliminate anti-environmental, social, and governance (ESG) activities from their investments. To assess these companies, the client sought Benori’s support to: Gather secondary data on each company and its investment policies and ESG focus Rate them according to a specific list of indicators and the parameters

Approach

We conducted extensive secondary research to understand the guidelines, policies, actions, and activities related to ESG for asset management companies. This required a deep analysis of publicly available information and media activities for these companies and their group companies to ascertain their ratings.

Impact

The report helped the client in: Understanding the commitment and focus of global asset managers towards ESG Gauge their level of commitment towards ESG and take decisions and advise companies on ways to achieve a net-zero financial system

Technology, Product, and Partner Landscape of Sustainable Rigid and Flexible Packaging

Objective & Scope

The client, a global FMCG company, wanted to assess its readiness for sustainable packaging by looking at related dynamics in the space across industries. For this, it wanted Benori’s support in: Identifying technologies, products, and partners providing scalable solutions for rigid and flexible packaging Shortlisting solutions that are recyclable by design, environmentally compostable, have a low carbon footprint, and a zero fossil fuel feedstock approach

Approach

The research included information capturing around technologies, patents, products, and start-ups in the rigid and flexible sustainable packaging space. We looked for various universities and their research work in this field. Partner scouting was conducted through primary research to understand how these universities, start-ups, and other companies have invested in sustainable packaging and to gather insights to support the client’s requirements.

Impact

The research helped the client to take strategic business decisions towards capability building in: Superior recycled materials for rigids such as High-Density Polyethylene (HDPE), Polypropylene (PP), and Polyethylene Terephthalate (PET) Fully recyclable flexibles Non-persistent biodegradable flexibles

Analyzing the Adoption of AI/ML Technologies Across Various Industries in India

Objective & Scope

The client, a top consulting firm, wanted to understand the level of adoption of artificial intelligence/machine learning (AI/ML) technologies across various business functions of different industries in India. It sought Benori’s support to conduct a survey among relevant stakeholders and get insights into: The industries that are in the early stages of adoption of AI/ML The departments, including human resources, marketing, finance, etc., which are the early adopters Present and future use cases of AI/ML implementation for different industries

Approach

We conducted more than 200 primary interviews with key decision-makers across several industries to understand AI/ML technology adoption across departments, the level of implementation, and future strategies. We reached out to designations ranging from senior managers to CXOs to get the insights.

Impact

The research helped the client understand the types of companies and functions in which AI/ML is being implemented and gain insights into: The upcoming plans of various companies/industries to increase the adoption of AI/ML The industries that are the leaders and laggards in the AI/ML adoption Challenges faced by various industries and how the client can help them to increase adoption of AI/ML

Assessing the Cloud Management Platforms (CMP) Market

Objective & Scope

The client, an IT service management company, wanted to develop a competitive business strategy and identify CMP's focus areas. For this, it wanted Benori's support for the following: Sizing the CMP market, as per the standardized parameters of segmentation in Turkey, India, Saudi Arabia, the United Arab Emirates, Kenya, and Nigeria Understanding market dynamics, demand, and developments of the CMP business Competitor analysis of leading CMP firms covering overview, offerings, focus areas, and business strategies

Approach

We conducted extensive secondary and primary research, followed by expert consultations to validate and obtain a third-party perspective. Through secondary research, we analyzed market dynamics, regional demand, industry trends, consumer behavior, and future market potential. We prepared a data model to estimate the market size and public cloud revenue and spending for each country. We conducted expert interviews to identify gaps and validate the data and information collected.

Impact

The research helped the client in: Understanding the market size and the attributes of CMP at the global level, as well as the key areas of the CMP market that have high growth potential Gaining competitive insights around key offerings, business strategies, focus areas, and others Understanding market dynamics that facilitated the growth with respect to the marketplace and attributes

Conducting Cost Breakdown Analysis of Water Purifiers

Objective & Scope

The client, a leading consumer products company, wanted to understand the best practices and cost analysis of manufacturing, distribution, and sales models for key competitors in the reverse osmosis (RO) and ultraviolet (UV) water purifier segment. The client wanted Benori’s assistance in conducting a detailed competitive intelligence on the top manufacturers in India. The study focused on creating detailed competitor profiles covering market intelligence parameters, such as product profit and loss (P&L), revenue models, supply chain models, sales channels, retailer margins, service models, operational costs, overheads, and organizational structures of the target companies.

Approach

We conducted secondary and exhaustive primary research to understand the operations involving in-house and outsourced operations, information related to call centers and services, distribution, and sales channels. We then conducted telephonic interviews with distributors, retailers, senior stakeholders, and sales and purchase teams at the target companies to gain an in-depth understanding of the cost breakdown and best practices.

Impact

The detailed insights helped the client in enhancing its overall operations efficiency and increasing the return on investment (ROI) by: Gaining a deeper understanding of the top manufacturer’s best practices in the RO & UV specific segments Shaping its routine operational strategy, including strategic decisions such as suitable sales and supply channels, and cost-based decisions

Understanding the State of Metaverse in India

Objective & Scope

The client, a management consulting firm, wanted to understand the current state of the Metaverse in India, including the reasons for its popularity, user demographics, engagement levels, and business strategies. For this, it sought Benori’s support in understanding: The engagement of Indian companies with Metaverse and their plans in terms of talent, skills, and related technologies The challenges faced in the adoption of the Metaverse

Approach

We conducted an online survey of industry leaders from 100–120 companies across various industries to gain insights into user demographics, assess their knowledge of the metaverse, and learn about their companies’ adoption strategies for the Metaverse.

Impact

The research helped the client in understanding: Awareness, acceptance, and adoption levels of Metaverse among various industries and business leaders Availability of necessary talent to leverage the Metaverse to its full potential Key concerns surrounding the adoption of the Metaverse

Benchmarking Market Competitiveness and Regulations in Global Automotive Industry

Objective & Scope

The client, a global consulting firm, was working for a KSA-based government entity that wanted to understand and benchmark the competitive environment in the global automotive industry. For this, it sought Benori’s support to: Understand the market structure and performance across the value chain of the automotive sector Identify the competitive environment and competition regulations for marketing, sales, and after-sales of cars Benchmark the findings across the developed, developing, and underdeveloped countries

Approach

We conducted extensive secondary research to understand the market structure, value chain, and the competitive environment. We conducted in-depth interviews to understand stakeholders’ perspectives on the competitive environment. Industry experts were interviewed to understand the competitive regulations and their impact on the stakeholders. Based on the findings, we created a data model to benchmark countries by their competitive environment and industry maturity.

Impact

The research findings helped the client to understand: The current market structure, performance, and competitive scenario across the global automotive value chain The adopted anti-competitive regulations and global best practices in terms of competition regulation in the automotive sector Policies and regulations that can be adopted to ensure fair competition in the automotive industry

Assessing India’s Talent Supply Chain for a Talent Assessment Company

Objective & Scope

The client, an India-based online talent assessment company, wanted to gain thorough insights into the employability of the talent pool in India and the demand across various industries. Based on this analysis, the client wanted Benori’s support to identify and highlight the skills and knowledge gaps in the talent supply chain.

Approach

We undertook extensive secondary research on India and global talent and job market trends and scenarios, and analyzed online survey data. Data from these methods was collated in a report, which consisted of data analysis and insights from surveys and industry-wide discussions with senior HR professionals, sectoral dossiers for six major industries, and an anchor article on reshaping India’s workforce.

Impact

The report, co-authored with the client, helped in: Understanding the employability scenario in India vis-à-vis demand from industries Delivering information and actionable insights for better policy making and guiding academia, students, and corporates on the next steps to bridge the gaps

Conducting Study on Cryptocurrency Market in the Middle East

Objective & Scope

The client, a management consulting company, wanted to publish a research paper on the emergence and growth of cryptocurrency in the Middle East market. It sought Benori’s support to understand: Growth in crypto exchanges, covering both domestic and international, targeting the Middle East market Regulations/licensing on crypto trading and exchanges in key GCC markets The comparison of the pros and cons of establishing a crypto exchange in Abu Dhabi, Dubai, and Bahrain

Approach

We studied the cryptocurrency market in the Middle East. The report covered the emergence of cryptocurrency in the region, growth areas in the local market, along with trends, drivers, government initiatives, and regulatory frameworks of key countries and globally, and how to establish a crypto exchange. More emphasis was placed on the licensing regulations followed in various countries in the Middle East.

Methodology

Our research helped the client in: Gaining an understanding of the cryptocurrency market in the Middle East, its emergence in different countries, and growth parameters Analyzing key licensing and regulations across different countries in the Middle East

Conducting a Price Benchmarking Study for e-Powertrains in India

Objective & Scope

The client, an EV component manufacturer, wanted to benchmark the prices and specifications of their e-powertrain products with comparable products from competitors in India for two-wheelers (2Ws), three-wheelers (3Ws), and entry-level four-wheelers (4Ws). They also wanted to understand the premium original equipment manufacturers (OEMs) pay for innovative enhancements to e-powertrain solutions. For this, they sought Benori to conduct a benchmarking exercise across the following product categories: Hub motors Mid motors Controllers

Approach

We conducted extensive primary and secondary research to collect information on various critical parameters and differentiating factors for the motors and controllers of 15–16 players in the structured and unstructured segments. We also asked them for innovations/enhancements in their product portfolios and the price range for such products. We then triangulated the information by speaking to 4–5 OEMs and other industry experts working in the domain.

Impact

The client was able to understand and assess: Competitor’s prices for products with similar specifications and efficiencies, and benchmark them to their own product portfolio The premium OEMs are already paying or intend to pay for product efficiencies, innovations, or enhancements in motors and controllers

Benchmarking the Technologies and Software of Used Car Platform

Objective & Scope

The client, a global consulting firm, required Benori to benchmark the technologies and software used by the online used car platforms across selected markets, with in-depth information related to: Technologies and related software used for the entire customer journey and interface for selecting digital used car platforms Digital tools comparison across the value chain, including inspection, evaluation, chatbot, pricing, auction, connected devices, and online recommender, along with the associated cost and development time, wherever applicable

Approach

We conducted extensive secondary research and in-depth primary interviews with senior technology executives working in used car companies to understand the technologies involved across the value chain. We provided insights on digital tool interventions while sourcing and retailing a car, emphasizing user interface/user experience (UI/UX), front-end and back-end frameworks and languages, APIs, security layers, and data sources.

Impact

Our research helped the client in: Gaining an understanding of the technologies and software involved in various stages of the customer journey while buying or selling a used car, along with their after-sales support and communication Benchmarking the key players based on the used-car platform for their digital tools’ adoption across the value chain Understanding the technology enhancements pre and post-COVID

Conducting a Capacity Intelligence Study for the Beverage Segment in India

Objective & Scope

The client, a global FMCG major, wanted to assess their headroom for growth by looking at beverage production capacities of 20+ competitors in India. The assessment included tracking of unutilized capacity by category and regions. For this, Benori conducted a market study focusing on the following categories for the target companies: Carbonated soft drinks (CSD) Juice Water Value-added dairy (VAD) Energy drink Others

Approach

We conducted extensive primary and secondary research to collect information on the following parameters: plant location, ownership type, brands/pack types, number of production lines with capacities, overall plant capacity, capacity utilization, and annual production. Using the above information, we calculated the unused volumes and capacity headroom available across states for players and their respective categories and presented the results in a dashboard.

Impact

The client was able to understand and assess: Free capacities available for all players by region, state, and category Executed and planned investments by the competition, which helped them refine their India expansion strategies

Providing Location Analysis for a Two-Wheeler (2W) Production Plant in Southeast Asia

Objective & Scope

The client, a leading multinational professional services firm, was working for a renowned two-wheeler (2W) manufacturer in India. For this, it sought Benori’s assistance in conducting a feasibility analysis of eight South East Asian (SEA) countries to set up a 2W manufacturing plant. The study is divided into two broad phases: Phase 1: Feasibility analysis of countries and selection of the market Phase 2: Location selection for the shortlisted countries

Approach

In phase 1, we conducted extensive secondary research to understand and collect information on the eight SEA countries. Data was collected on macro-economic, critical, and sector-specific factors to select the top two favorable countries for 2W production. In phase 2, extensive secondary research was followed by in-depth interviews with senior-level executives to collect information on the two selected countries. We evaluated various parameters, including automotive, infrastructure, utilities, manpower, and country-specific factors, and benchmarked them against a scorecard to arrive at the location preferences for a new 2W plant.

Impact

The research helped shape the client’s strategy for operating in the SEA 2W automotive sector by: Gaining a deep understanding of the market for 2W manufacturing in SEA countries Providing a detailed attractiveness matrix to narrow down to a particular country and then to a specific location where they could potentially set up the 2W manufacturing unit

Understanding the Journey of India on Completion of Five Years of GST

Objective & Scope

The client, a global professional services firm, wanted to understand the tax journey of companies since the launch of the goods and services tax (GST) in 2017 in India. For this, it sought Benori’s support to assess and analyze: The impact of GST on businesses Government initiatives and use of technology by the government Key issues/concerns related to taxation, industry expectations, and future proposals

Approach

We conducted a web-based survey with C-suite executives across multiple industries to understand organizations' tax journeys, the steps that can spur growth in their sectors, the level of satisfaction with current information technology (IT) systems and automation, and the key issues related to compliance and industry expectations.

Impact

The research helped the client in: Understanding the journey of companies with respect to GST across sectors Analyzing the impact, efficiency, and future expectations of various industries Key issues and concerns in complying with GST law, challenges in litigation, and satisfaction with IT systems and automation

Scouting Unique Technologies across Five Areas of Interest in India

Objective & Scope

The client, a leading FMCG firm, planned to accelerate innovation in India through collaborations with academia, start-ups, and small and medium-sized enterprises (SMEs), particularly in the areas of interest related to sustainability, digitalization, and ingredients. They sought Benori’s support to: Identify technologies that possess distinctive and valuable strengths in India in the past two years Analyze market dynamics, technologies, products, collaborations, and partnerships for potential collaboration opportunities Scoping the current landscape for further development in specific fields

Approach

We conducted secondary research, covering patents, scientific literature, clinical trials, products (with or without scientific evidence), and news sources to identify relevant technologies. The findings were further examined to derive insights into their claims, potential applications, research popularity, technology readiness level (TRL), and partnerships.

Impact

The research helped the client to: Identify key companies, academic projects, and SMEs fit for potential collaboration based on the client's area of interest through their technological offerings Identify the companies’ TRL by classifying them as conceptual stage, development stage, or commercial stage projects