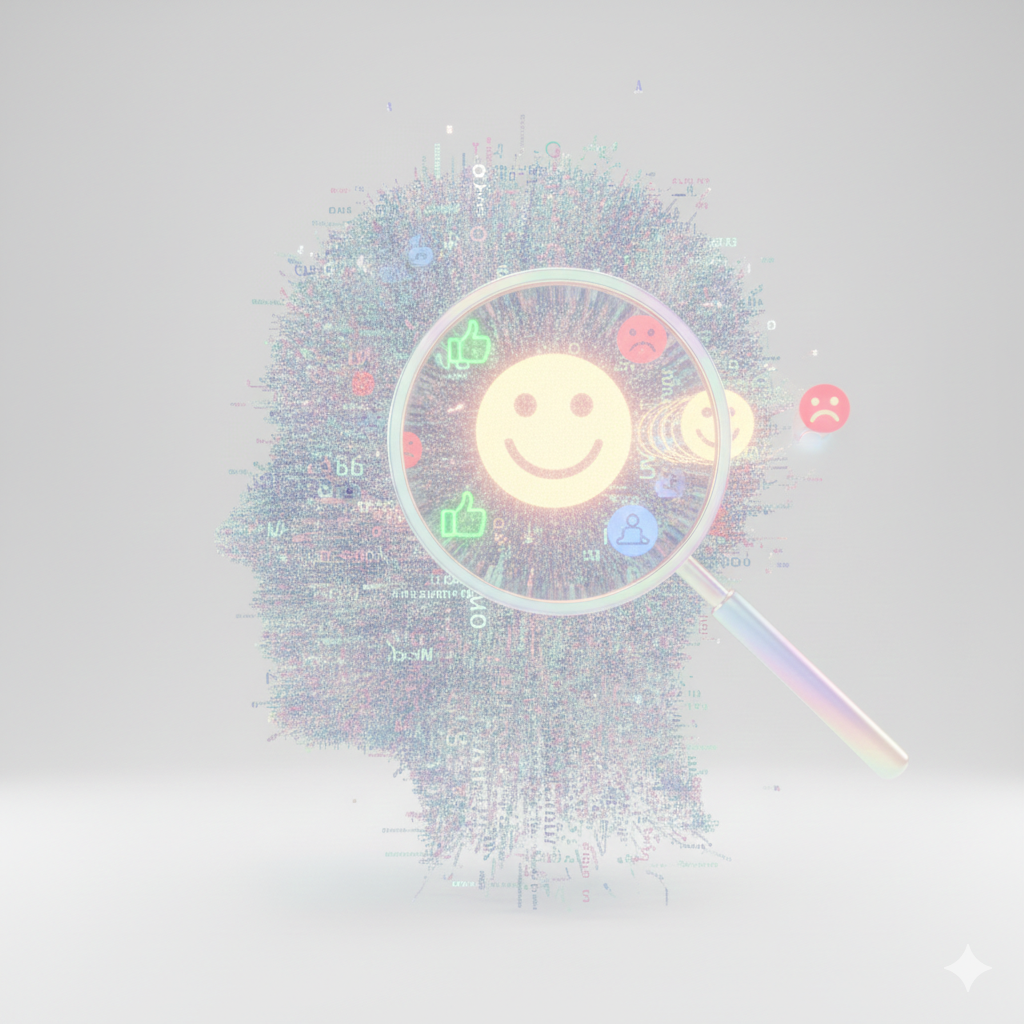

Conducting Sentiment Analysis for Benchmarking Competitors

Objective and Scope:

The client, a consulting and advisory firm, wanted to assess brand perception and customer satisfaction and conduct a comparative benchmarking analysis of three companies. For this, it sought Benori's support in: Analyzing customer feedback, reviews, and ratings to identify key pain points and positive experiences Comparing customer perceptions across the selected companies to understand relative strengths and weaknesses Identifying opportunities for service enhancements and competitive differentiation

Approach:

Benori employed web scraping to collect customer feedback from platforms such as review sites and travel forums. Used GenAI capabilities, including LLMs, to analyze sentiment across the entire customer journey, from bookings to room services. Iterative prompt engineering was applied to refine sentiment classification into positive, negative, or neutral.

Impact:

The study enabled the client to Benchmark brand perception across three companies to understand competitive positioning Develop data-driven strategies to boost customer satisfaction and loyalty Enhance communication and marketing initiatives using sentiment trends and feedback analysis